How's the view up there? 🌎

Two billionaires go to space, two billionaires discuss Bitcoin, and wealth inequality continues to widen. This is Issue #018 of Forward.

Do you have a retirement plan? 🤔

Most people would look back at a long and successful stint in their career and think about taking an island vacation.

Jeff Bezos decided he’d go hang out at the edge of space instead.

With the successful completion of his zero gravity voyage, Bezos has joined fellow billionaire Richard Branson in achieving the feat, just a few days apart. The Amazon founder’s subsequent comments about customers and shareholders helping pay for his jaunt have been ill-received and sparked a new wave of commentary about billionaires being a pox on humanity. But the fact remains, it’s the billionaires who’re willing to push the boundaries of what humans think is possible.

It’s Virgin Galactic that’s selling tickets for space tourism, it’s Elon Musk’s SpaceX that is building the Starlink system to provide affordable high speed Internet across the globe.

Billionaires. You can hate ‘em, but you can’t ignore them.

If you haven’t signed up to receive Forward directly in your inbox, you can do so by subscribing below. Forward is delivered twice a month on Sundays in time for your morning ☕.

Quality content. No spam. Subscribe now. 👇

What’s up with the economists? 🤷♂️

Speaking of Jeff Bezos, do you know how rich the man is? There’s a nifty site that lets you choose a billionaire and try to spend their money. We started spending the Amazon founder’s wealth by buying Happy Meals and eventually graduated to fighter jets, Falcon 9 rockets, and ending homelessness, with plenty left over.

Go on, give it a try.

This yawning chasm of wealth inequality is sparking a lot of conversation, particularly regarding how economists appear to be uninterested in advising the government to intervene and correct these imbalances. Like this one:

It’s a tough debate, but here’s a nuanced take by Noah Smith in response to the tweet.

Investing is in now 😎

There used to be a time when words like ‘learner’, ‘engineer’, and ‘designer’ dominated most social profile bios. Now, everyone and their uncle is an ‘investor’.

Snark aside, the sorry state of affairs with rising inflation and dwindling wages has left most people with little choice. The great thing however, is that the nature of investing itself is dynamically changing — as people invest not just in companies, but also events and other people.

As the Internet democratises opportunity, fascinating new marketplaces are springing up to invest in long term opportunities, and the possibilities are limitless.

By the way, do you know how investing truly began? Check out this fascinating read that covers the history of investing — from preserving meat to becoming a byproduct of increasing lifespans.

A degree in financial ruin 🎓

The USA has a student debt problem. This is known.

And thanks to federal student loans, the government has little incentive to fix this problem, because they are the benefactors of an up and coming generation drowning in crippling debt.

As Mike Solana points out with this cutting statement — student misery is a federal asset.

Interestingly however, even as millennials and Gen Z struggle to stay afloat, America’s population aged 70+ apparently has a net worth of roughly $35 trillion.

As debts are getting bigger, inheritances are growing larger. Unfortunately, the two are unlikely to cancel out, and wealth gaps will continue to widen.

The Bitcoin Brothers 🤝

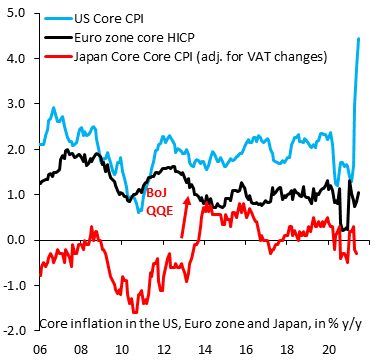

One of Bitcoin’s most staunch supporters is undoubtedly Anthony Pompliano. One would think he’d run out of things to say about Bitcoin eventually, but the US economy is just one of those gifts that keeps on giving. The latest fumble to feature on Pomp’s newsletter? The sharp rise in inflation in the country.

Here’s a little diagram showing how sharp that spike was:

Meanwhile, two other Bitcoin enthusiasts — Elon Musk and Jack Dorsey — took their discussions about the cryptocurrency off Twitter and joined ARK Investment Management’s Cathie Wood for a chat about why they’re bullish on Bitcoin, it’s applications and challenges.

(Oh, and Bitcoin HODLers out there, fret not. Musk says that while he might pump, he has no intention to dump).

"Every opportunity is attached to a person. Opportunities do not float like clouds in the sky. They’re attached to people. If you’re looking for an opportunity — including one that has a financial payoff — you’re really looking for a person."

— Ben Casnocha

Stuff we loved this week 👍

How much do you know about the Rothschilds? (Besides those wild YouTube conspiracy theory videos that say they secretly run the world). In truth, the European banking family’s history is a case study in how power and geopolitical influence is easier won through coin than conflict. Find out more about their history on this episode of How to Take Over the World.

Or read this thread on Nathan Rothschild over on our sister brand Yodaa’s Twitter page:

One of the great things about being an investor or a trader and exposing yourself to a string of risk-reward decisions, is that you begin to appreciate that life is a game of probability. The ones who understand this and play the game accordingly usually have better odds of success.

The problem, as Morgan Housel points out, is that humans suck at probability.

Food for thought 💡

We talk a lot about the world economy being fundamentally unsound at the moment. If you’ve ever wanted to explore the reasons a little deeper, here’s an aptly titled post:

While technology makes everything cheaper, why is investing and transacting in assets of value still so expensive? The answer: middlemen. Even as we remove inefficiencies in every other industry, finance remains the last bastion of paper pushing middlemen seeking a slice of the pie.

We’ll leave you with a parting question: how do you measure wealth?

No, not money, wealth.

If you have an answer, you have our respect. If you’re struggling to come up with one, we’ll leave you once again with Morgan Housel, for one of life’s most important understandings.

If you think this newsletter made your Sunday morning a little better, please spread the love and send it to your friends. We’ll see you again in two weeks.

Until next time,

Your friends at NEO